NVIDIA (Nasdaq: NVDA)) Remains in the spotlight while the world of technology weighs the implications of the last breakthrough of Deepseek – A chatbot providing equal results with TOP models while only using a fraction of the computing power. As a dominant player in IA Chips, Nvidia now faces the question of whether this change could reshape the demand for its high performance equipment.

Maximize your wallet with data -based information:

- Take advantage of the power of Tipranks intelligent scoreA data -based tool to help you discover the most efficient actions and make informed investment decisions.

- Monitor your stock choices and compare them to the recommendations of Top Wall Street analysts with Your smart wallet

It is not the only storm cloud on the horizon. The imminent threat of a world trade war, with 100% prices offered on imported semiconductors, adds another layer of uncertainty.

Some investors are not waiting to see how it all happens – Nvidia’s shares have already dropped 19% in last and a half week as concerns settled.

Although recognizing this “double blow” caused by Deepseek and potential commercial disturbances, the best investor James Foord – which is in the most important 4% of Tipranks pros – declines an opportunity.

“The purchase of NVIDIA around $ 90 at $ 100 before the benefit of the fourth quarter is a strategic decision,” notes the 5 -star investor.

Foord died by depth and price concerns, believing that these risks are not as austere as some fear.

Regarding Deepseek, the investor quotes the Jevons paradox to ensure that the request for IA equipment will remain hale and warm. According to Jevons, explains Foord, when a resource becomes cheaper, it also becomes more widely used.

“Now that AI applications are in fact affordable, there are potentially millions of companies and users who will be interested in deploying large languages or LLM models, and this is always very good for Nvidia,” said The investor.

With regard to tariff disorders, Foord thinks that Nvidia’s pricing power will allow it to transmit higher costs to customers, guaranteeing its margins in the process.

In addition, Foord is not too concerned that the primacy of Nvidia is in danger, citing Cuda software from the head of the company industry and the faithful leadership of Jensen Huang and its leadership framework .

“It is always the same group of people who have reached more than 90% domination in the GPUs thanks to a superior vision and execution, and I believe that we will continue to see this in the years to come,” concludes Foord.

To this end, the investor evaluates NVDA a solid purchase, hoping to engulf the shares of around $ 100. (To look at the history of Foord, Click here))

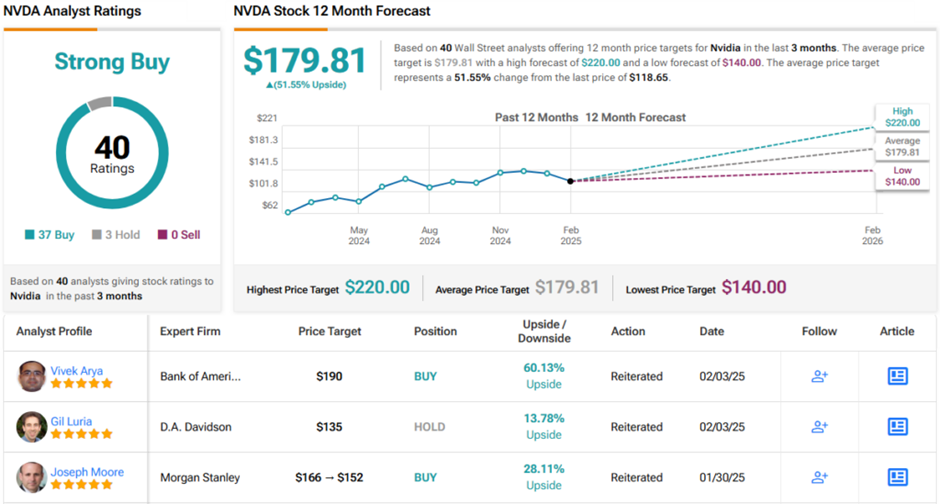

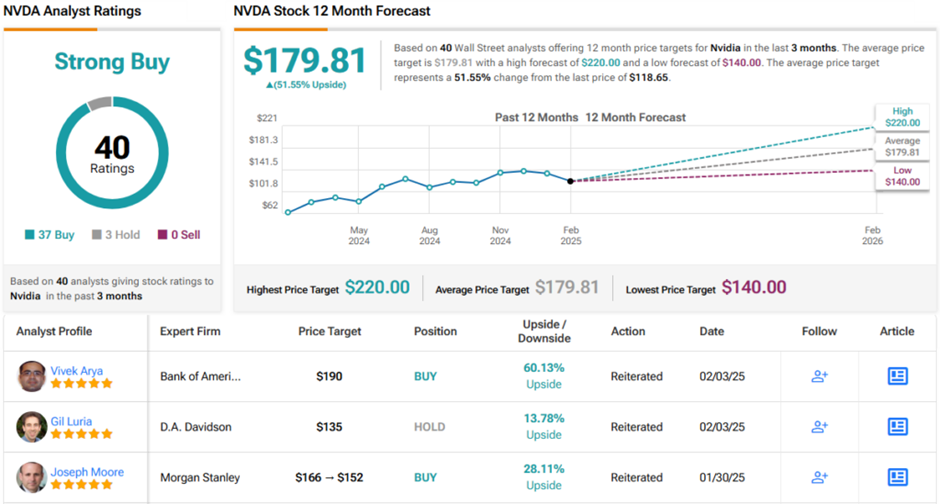

Wall Street echoes its upward position. With 37 purchases and only 3 sockets, NVDA has a solid purchase consensus. Its average price target of 12 months of $ 179.81 implies a potential increase of 51% of the coming year. (See NVDA actions forecast))

To find good ideas for actions that are negotiated with attractive assessments, visit Tipranks’ Best actions to buyA tool that unites all information on Tipranks actions.

Warning: The opinions expressed in this article are only those of the star investor. Content is intended to be used for information only. It is very important to do your own analysis before investing.