NVIDIA (Nasdaq: NVDA)) Actions have experienced a good gathering today, increasing almost 5%. However, the stock has not completely recovered from the recent bomb fallen by Chinese depth – a IA Model which corresponds to its American rivals in performance but has been developed at a cost fraction.

Maximize your wallet with data -based information:

- Take advantage of the power of Tipranks intelligent scoreA data -based tool to help you discover the most efficient actions and make informed investment decisions.

- Monitor your stock choices and compare them to the recommendations of Top Wall Street analysts with Your smart wallet

Although there has been a lot of perspective on Deepseek’s claims on reduced costs, but DA Davidson’s analyst Gil Luria, who ranks among the 4% of street stock market experts, thinks that entry Deepseek suggests that a huge change is about to occur.

“We continue to believe that the introduction of Deepseek has changed the situation and a big leap forward for AI,” said Luria. “Our key observation is that AI has become radically more effective in the last two weeks, and we have found significant support that the reduction in calculation is in the beach from 90 to 97%.”

If this is true, it could express trouble for Nvidia.

“We believe that we are approaching the peak demand, perhaps this year that the great customers of the NVDA assess these recent developments,” warned the 5-star analyst.

Addressing skepticism around Deepseek, Luria addressed the affirmations that the model “It’s not really much better. “” He stresses that several coders have reported significantly improved inference efficiency – an observation taken up by AI managers, including the founder of Anthropic. A higher AI company even reported a 93% reduction of 93% using Deepseek.

And what about the theory that the $ 2 / million Dollars of Deepseek’s theory of $ 2 / million dollars undermines the market at a loss? It seems unlikely, says Luria, given its effectiveness. Other open source models now charge $ 6 / million or less, and Openai recently lowered its O3 price to 4 / million dollars.

In addition, Luria says that the argument that “the training cost complaint of $ 6 million is a false” does not change the previous points. His research suggests that the costs was greater than 10 times, and total Deepseek expenses are estimated at $ 500 million – still well below $ 10 billion Openai.

“We do not know how this logic takes place for NVDA – either you believe that DS has used as many advanced NVDA chips as Optaai, in which case the sanctions will come back, or you believe that they did not do it , in which case you do not really need it of the most advanced chips and the training cost a small fraction, ”says the analyst.

Finally, the Jevons paradox was a lot raised in the current argument, its use by drawing a caustic remark by Luria that this previously obscure concept is now used in any discussion linked to Deepseek. Luria says that, although lower prices generally stimulate a higher demand, this effect has historically taken time to materialize. The analyst believes that the drop in inference prices will help companies deploy tools faster, but he does not expect an increase in demand of 20-30x short-term to compensate for the reduced calculation need. The “real trigger factor” is the availability of evolutionary applications, which can take 2-3 years to develop. “More importantly with regard to NVDA,” added Luria, “if these new applications are deployed on the device, increased demand may not increase the TAM.”

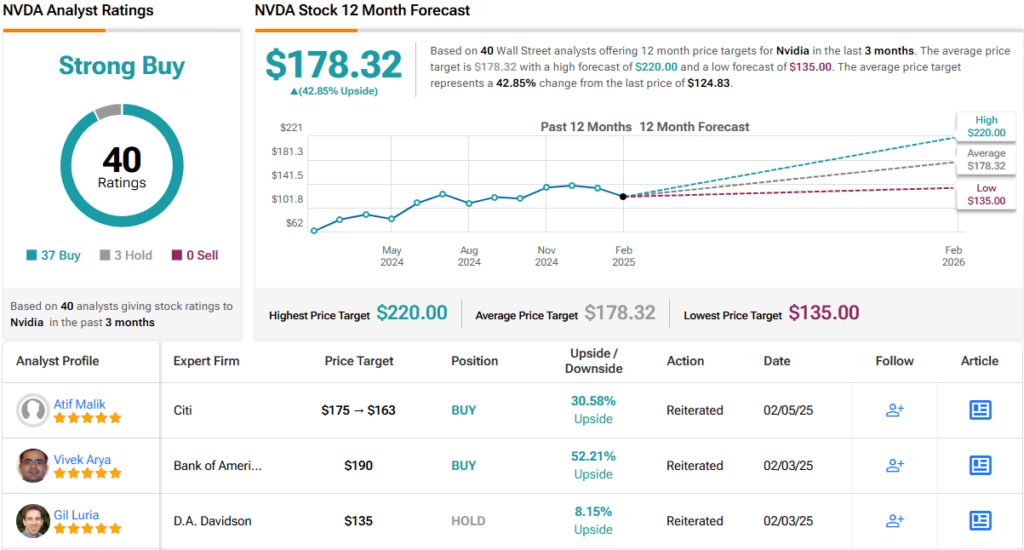

All in all, Luria prizes NVDA Actions A neutral, and her price target of $ 135 suggests that shares will increase 8% in the next 12 months, very timid of overvoltage of 80% of last year. (To look at the history of Luria, Click here))

Luria, however, is part of a minority at Wall Street; Two other analysts join him on the sidelines, but with 37 additional purchases, the analyst’s consensus assesses Stock Buy. By going through the average price target of $ 178.32, in a year, actions will modify hands for a bonus of ~ 43%. (See NVIDIA stock forecasts))

To find good ideas for AI actions that are negotiated to attractive assessments, visit Tipranks’ Best actions to buyA tool that unites all information on Tipranks actions.

Warning: The opinions expressed in this article are only those of the featured analyst. Content is intended to be used for information only. It is very important to do your own analysis before investing.