NVIDIA (Nasdaq: NVDA)) Is it not the first name that comes to mind in health care, but its deep influence makes it a solid competitor to dominate another industry.

This is the point of view of Cowen analyst, Joshua Buchalter, who, after discussions on investors with the vice-president of health care of Nvidia, Kimberly Powell, considers health care as “one of the largest and most important of Nvidia, and most important, future IA opportunities.”

The global health care industry is enormous, worth around 10 billions of dollars, with 30% of that spent for workers, laboratories and physical facilities. Nvidia believes that accelerated IT can help improve these areas. During fiscal year 26, Buchalter expects the company to earn more than a billion dollars of health care. Although it is a good income transport for many companies, it is only a small part of the much larger data center activity in Nvidia – for the moment.

“For the moment” could be essential here because, according to Buchalter, the company is “extremely well placed to enter a significant value over time as R&D and Capex dollars in the global health care industry migrate to accelerated IT.”

On the one hand, Powell of Nvidia stressed that the improved performance and the total cost of possession (TCO) of Nvidia of the Blackwell architecture of Nvidia should contribute to a greater adoption in the health care industry.

But there are also three key growth areas that the company has identified which will stimulate its medium -term health opportunities: (1) the discovery of drugs; (2) Digital devices and imaging; and (3) digital health.

In Drug Discovery, Nvidia now estimates that there is an annual expenditure of $ 300 billion, compared to around 250 billion dollars last year – which is expected to go to IT over time.

In digital devices, the opportunity is still in its early stages, but the Cosmos foundation model of Nvidia as well as Omovers could be a “potential breakthrough”, because it allows multi -time simulations which can help form surgical robots powered by AI. In digital health, AI rationalizes workflows to save time and money while improving patient care. The newly announced Llama Nemotron LLMS are designed to create AI agents capable of analyzing and responding to the images and videos of the hospital, which makes Nvidia “well positioned for the age of agentics”.

Regarding Buchalter, there is no doubt that Nvidia should remain the leader in accelerated IT, health care representing another opportunity.

“In the long term, a series of higher technologies, a long pedigree of innovation and in -depth growth -oriented investments should allow significant and higher growth through the vast segment of business data with a set of enlargement of material verticals such as health care that emerges quickly,” the analyst has summed up.

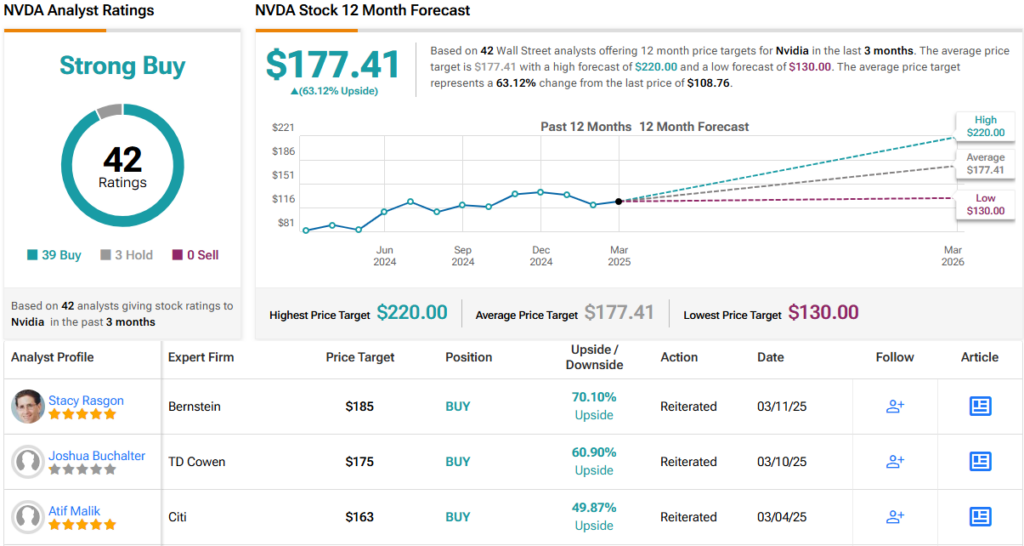

Conclusion, BUCHALTER prunes NVDA shares as a purchase, as well as a price target of $ 175. Involvement for investors? An advantage of around 61% compared to current levels. (To look at the history of Buchalter, Click here))

The average street objective is only a higher touch; At $ 177.41, the figure suggests that shares will increase by 63% in the coming months. All in all, NVDA shares are demanding a high purchase consensus rating, based on a mixture of 39 purchases against 3 holds. (See NVDA actions forecast))

To find good ideas for actions that are negotiated with attractive assessments, visit Tipranks’ Best actions to buyA tool that unites all information on Tipranks actions.

Warning: The opinions expressed in this article are only those of the featured analyst. Content is intended to be used for information only. It is very important to do your own analysis before investing.

Questions or comments about the article? Write to editor@tipranks.com