NVIDIA (Nasdaq: NVDA)) The stock could be a multi -year winner with its leadership in IA Chips which propelled directly to the top of the stock market food chain, but 2025 started in a rather silent way for the semi-manager.

Maximize your wallet with data -based information:

- Take advantage of the power of Tipranks intelligent scoreA data -based tool to help you discover the most efficient actions and make informed investment decisions.

- Monitor your stock choices and compare them to the recommendations of Top Wall Street analysts with Your smart wallet

The stock was subjected to painful losses, including a historic blow due to the noisy entry of Deepseek in the AI game. The latest AI model of the Chinese start-up has been hailed as a game changer because it can work as well as its American equivalents using much less calculation power and has apparently cost much less to develop. Since the GPUS infrastructure of Nvidia Power AI, investors fear that if Deepseek can equal or exceed the chatppt and the lama with less power of treatment, GPU demand could suffer.

However, with the stock of 4% since the start of the year, could this be an attractive entry point? Morgan Stanley’s analyst Joseph Moore, thinks, considering Deepseek sale as a “purchasing opportunity”.

While Moore is in depth as “a strong evolutionary upgrade in AI space”, it is only one of the many advances that have taken place in the past year. In addition, the signs that the model has been derived from owner sources, has improved by sacrificing certain security characteristics and subject to high latency if key expert data is missing, suggest that certain reference results may be optimized.

That said, the bear thesis for Nvidia is not fanciful and is based on a few key points. One of the concerns is the potential for export control, Moore believing that more restrictions are “almost certainly to come”. Another risk is the change of “financing environment” for IA expenses – before, investment in AI have encountered enthusiasm, but now there is a more in -depth examination due to “perceptions concerning the limitations of ‘ladder”. Finally, the feeling of investors has “become quite negative” and although the main IA infrastructure projects always grow in front, skepticism is high. It remains to be seen whether “the acceleration of income” can restore confidence.

That said, Moore has in no way become a lowering and remains “very optimistic about the way in which the balance of the year takes place”, highlighting several reasons why there remains a NVDA bull. Industry checks show that the demand for Topper gets buyster and is strong for Blackwell “in all forms”. Meanwhile, the feeling of investors around large IA training clusters has weakened, but the main cloud suppliers continue to develop, while inference workloads are also ready to stimulate growth to Long -term, Nvidia positioned although the market favors high performance solutions. And even if the ASICs have recently won a service compared to the GPUs, Moore expects the trend to be reversed in the second half, with the acceleration of GPU income probably exceeding the ASIC.

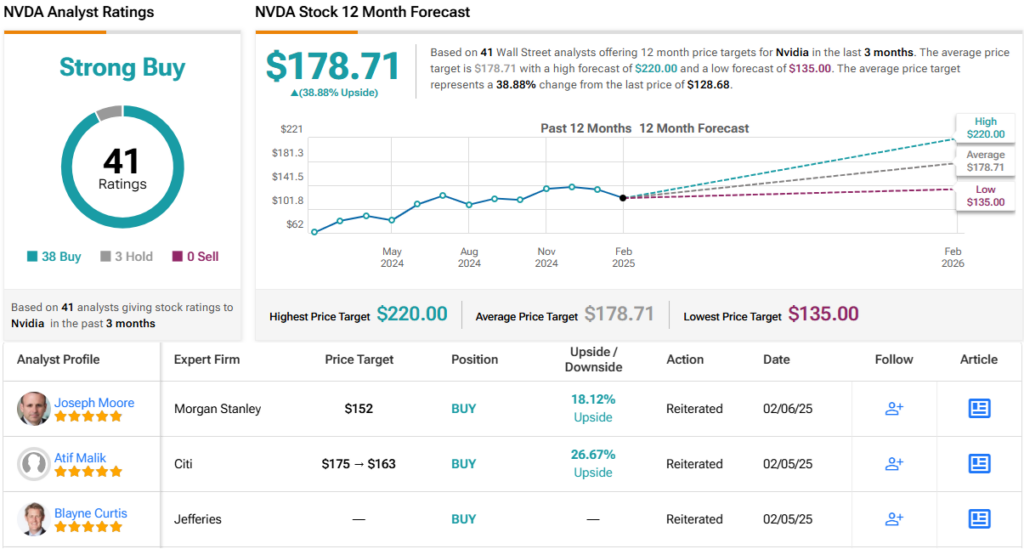

So, with all this to play, Nvidia remains a leading choice for Moore, who assesses the overweight stock (that is to say to buy). Its price target of $ 152 implies an increase in ~ 24% of current levels. (To look at the history of Moore, Click here))

Overall, Wall Street analysts are extremely optimistic about NVDA; Out of 41 reviews of recent analysts, 38 do it note a purchase, with only 3 opting for Hold. This results in a strong purchase consensus rating. For the future, the average price target of $ 178.71 indicates that shares could increase ~ 39% more in the next year. (See NVIDIA stock forecasts))

To find good ideas for actions that are negotiated with attractive assessments, visit Tipranks’ Best actions to buyA tool that unites all information on Tipranks actions.

Warning: The opinions expressed in this article are only those of the featured analyst. Content is intended to be used for information only. It is very important to do your own analysis before investing.