Nvidia (Nasdaqgs: NVDA) saw its actions slide 6% during last week, a surprising movement in the context of several important events and market trends. Block Inc.’s commitment to deploy the NVIDIA DGX Superpod, aimed at improving the training capacities of AI models, was a significant development, but it coincided with the drop in business prices. Despite this strategic decision, wider market pressures, including economic uncertainties and political concerns, have contributed to a difficult commercial environment. However, a recent report in the consumer price index has shown promising inflation data, stimulating a wider technological rally where Nvidia has initially jumped alongside peers like Tesla and Broadcom. Although the decrease in short -term prices is contrasted with the mid -week gains, it reflected a market sailing both optimistic and prudent economic signals. The global market itself fell 4% during the same period, influencing the trajectory of Nvidia prices despite its progress in AI.

Evaluate future NVIDIA’s profits from our detailed growth reports.

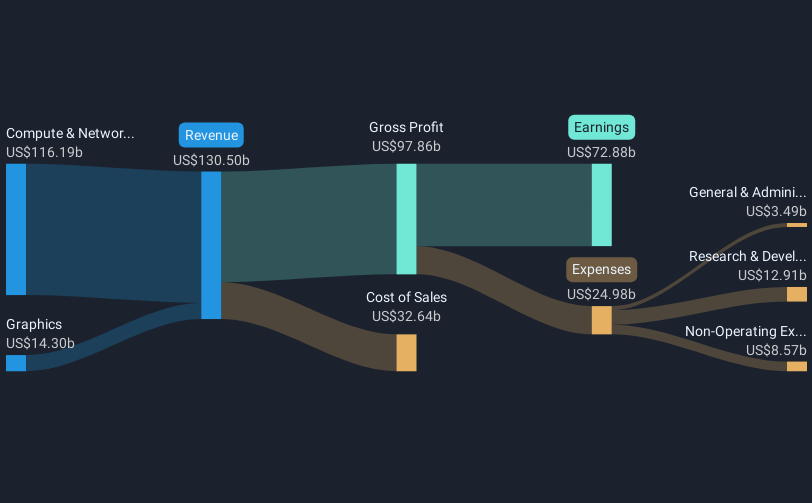

Over the past five years, the total NVIDIA shareholder yield has been a very large 1909.68%. This substantial growth reflects current developments and financial achievements. For example, Nvidia’s net income increased from $ 4.37 billion to 72.88 billion US dollars, which indicates its robust profitability sequence. Likewise, strategic alliances such as Nvidia’s collaboration with Google Cloud and Microsoft have improved its presence in the generative integration of AI and Cloud.

Despite solid financial results, certain market factors have presented challenges. The sale of remarkable initiates in the last three months has potentially reduced the confidence of investors. Meanwhile, the market assessment has shown that Nvidia trading below its fair estimated value of US $ 127.72, at US $ 108.76, suggesting a possible market pricing. In the past year, Nvidia’s performance has exceeded the American market and the semiconductor industry, focusing on its solid market position.

This article by simply Wall St is general. We provide comments based on historical data and analysts forecasts only using an impartial methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to purchase or sell stock and do not take into account your objectives or your financial situation. We aim to provide you with a long -term targeted analysis drawn by fundamental data. Note that our analysis may not take into account the latest ads of the company sensitive to prices or qualitative equipment. Simply Wall St has no position in the actions mentioned.

The evaluation is complex, but we are here to simplify it.

Find out if Nvidia could be undervalued or overvalued with our detailed analysis, with Estimates of fair value, potential risks, dividends, exchanges of initiates and its financial situation.

Do you have comments on this article? Concerned about content? Get in touch With us directly. Alternatively, e-mail editorial-am@simplywallst.com