Even if the news of the potential decreases in interest rates have led to the optimism that the IPO window could reopen and that things could improve in starting areas, it seems that the worldwide venture market not yet leveled: the first data of Manual Indicates that the global investment in CR in startups continued to slip into the fourth quarter of 2023.

The exchange explores startups, markets and money.

Read it every morning on Techcrunch + or get the exchange bulletin every Saturday.

Although things are sharply decreasing in the United States compared to the exhilarating days of 2021, investment trends seem to have largely reached a new normal – American startups have collected $ 37.5 billion in the fourth quarter of 2023, which was not much less than the $ 37.6 billion in the $ 37.6 billion in T2 2023 and the $ 39.8 billion in T2 2022.

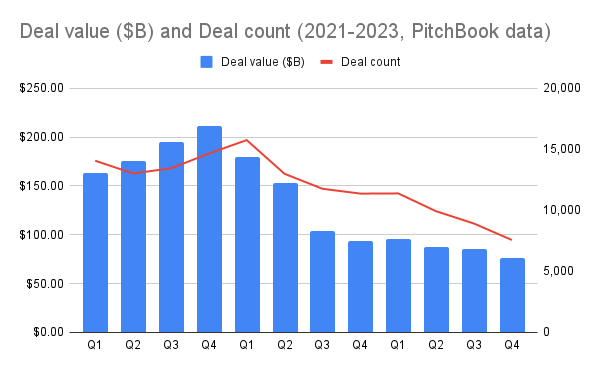

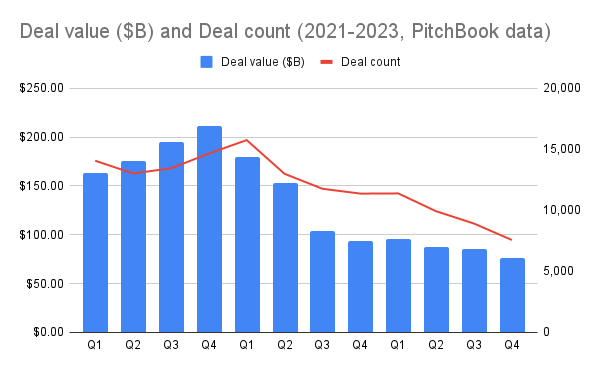

On the other hand, here is what is going on worldwide:

We always go down, friends!

To be honest, I expected to find a somewhat boring number in the fourth quarter, in the range of recent investment trends, not a Nadir. However, the annual totals have lost me a little.

Startups around the world collected around $ 345.7 billion last year, by Pitchbook. It is not a huge gap compared to the $ 333.4 billion collected in 2019 or the $ 351.2 billion collected in 2018. However, the result of the fourth quarter of 2023 of $ 76.6 billion is the amount The lowest that startups increased to the fourth trime better than it was really because we saw more money collected at the start of the quarters.

Thus, the situation has worsened regularly and if this continuous weakness persists during the new year, we could start to see the global retirement of venture capital investments with previous standards.

This is not an academic data point; This indicates that the assignments we feel in various start -up markets are very real. This is what I’m talking about:

It’s quite difficult there.

It’s a shame. One of the most interesting (and encouraging) developments in the company’s boom in 2021 has been that many capital has been invested in historically under-invested areas. This trend has almost disappeared, which means that a whole taking of startups there is probably found that the sources of critical capital have evaporated.

Be more cynical: the trend of each major geography by seeing a venture capital interest seems to have been – for the moment – a ZIRP phenomenon (zero policy of interest). Alas.

Worse still, investors themselves are increasing less capital now. According to Pitchbook, the venture capital companies in the world 2015, When VCS only raised $ 119.3 billion. For reference, VCS raised $ 174.9 billion in 2016, and this number reached a peak of $ 379.7 billion in 2021.

Just to connect the points: the venture capital collected less money last year, so there is probably less capital available for investments this year. This means that there is no reason to anticipate venture capital investments to rebound in a material way.

Of course, things could turn around. There are fortuitous interest rates could be reduced this year, which could help awaken things from the current slowdown. Without something important modifying the dynamics, I do not find a solid argument to explain why the venture capital activity of 2024 should recover. Some markets like Europe and the United States seem better placed to have a good year, but for the rest of the world, prospects seem weak.